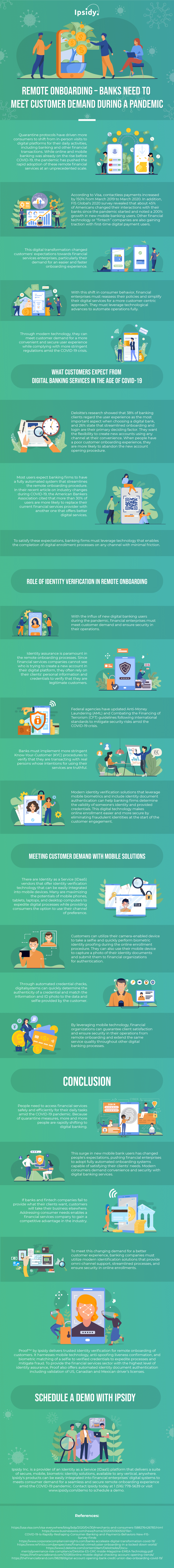

The coronavirus pandemic forced many people worldwide to stay at home as governments implemented strict quarantine protocols. As the world fought to keep the infection rate down, people started looking for banks that provide remote onboarding for their customers. Many finance companies have been using online and mobile banking solutions for years, but the pandemic pushed for their rapid adoption in more banks.

The number of contactless payments made has increased during the pandemic as more Americans started to rely on mobile banking and digital payments. Financial companies must ensure that their services have a customer-centric approach. Consumers’ behavior and demands have shifted thanks to the pandemic, and companies must make sure that they can meet them.

Customers demand a convenient and secure onboarding experience, and finance companies can meet this demand using FIDO authentication solutions. The customers can then use these solutions to have a passwordless login experience. Doing so also ensures that companies can verify whether the people registering with them are legitimate or not.

Financial technology companies gained significant traction with many first-time digital payment users. With modern customer authentication platforms, banks can streamline their processes to ensure that they provide excellent digital services amid the global crisis.

For more information on how banks can meet the current customer demand, check this infographic by Ipsidy.