authentication.png" alt="" width="168" height="168" />

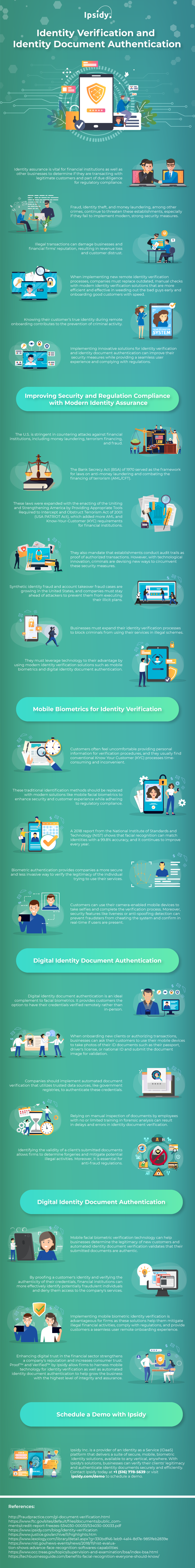

Digital transformation enabled businesses to operate remotely, providing their customers with an efficient and more convenient means of accessing their services. With the availability of electronic platforms, customers can create new accounts and complete transactions at their convenience.

Although digital services are created to streamline processes and enhance customer experience, fraudulent individuals try to take advantage of them. Criminals can use synthetic identities, fake identity documents, or even take over existing accounts to infiltrate the system and perform illicit acts.

With these cybersecurity threats, online identity verification becomes more imperative than ever. Anti-fraud regulations are more stringent about enhancing security measures among enterprises to deter criminal attacks. They emphasize adopting effective identity proofing methods to verify if the person interacting with a company is who they say they are.

Many are already using biometric multifactor authentication solutions (MFA) as an effective way of mitigating fraud. MFA works by enabling a layered defense against these threats and using robust authentication factors like facial recognition to determine real persons.

As most enterprises ask their clients to submit valid credentials for identity assurance, they must also leverage mobile technology to prove identity documents’ genuineness. Scammers often try to pass off a counterfeit document as a real ID to gain access to networks.

To know more about the importance of authenticating users’ identities and credentials, provided below is an infographic from Ipsidy.